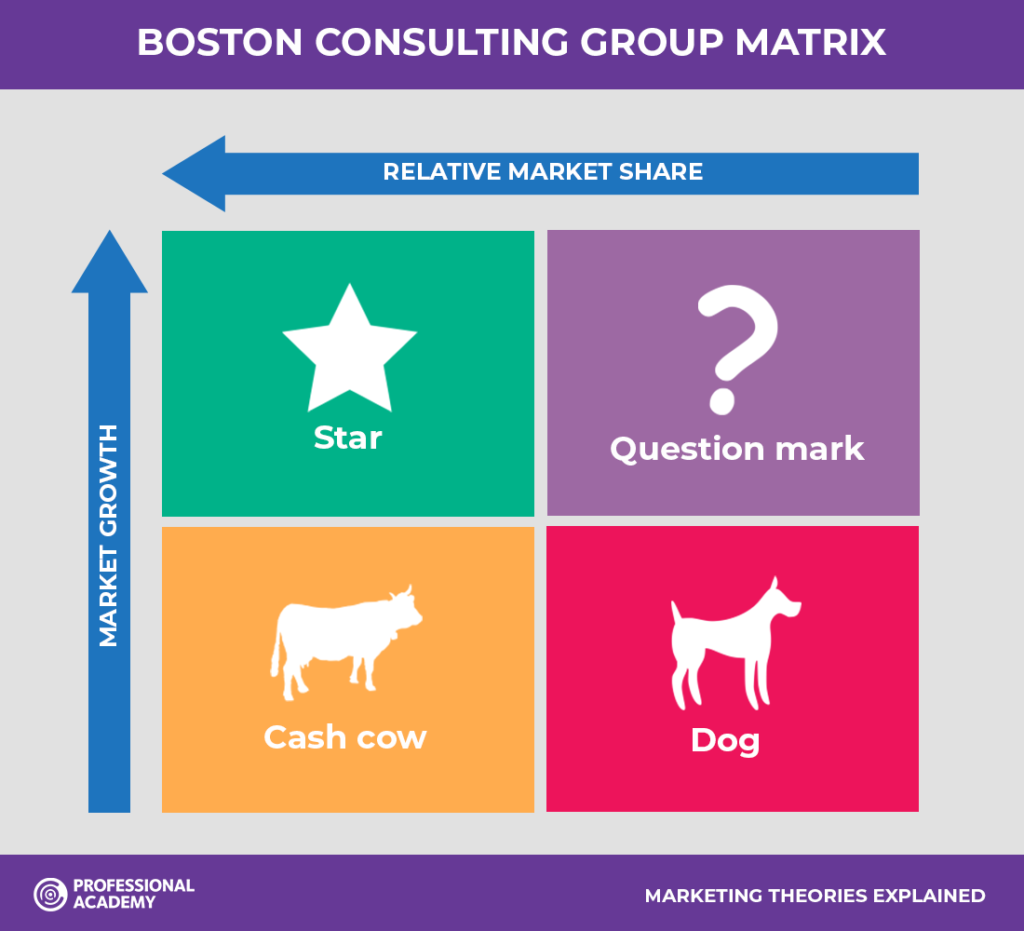

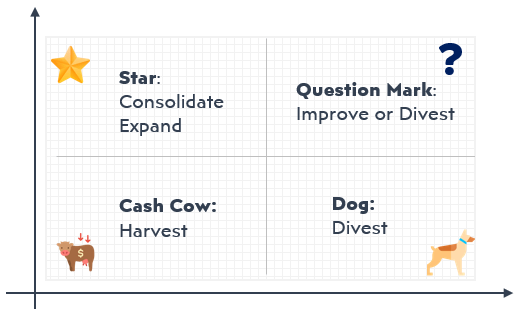

Question Marks → High Growth Low Market Share.Cash Cows → Low Growth High Market Share.The four quadrants of the BCG matrix are as follows. The structure of the BCG matrix plots a company’s products or strategic business units (SBUs) on a four-square matrix. BCG Growth Share Matrix: Four Quadrants Structure The BCG matrix assesses the growth opportunities available for a specific product portfolio by conducting a two-dimensional analysis based on two parameters:īy examining a product’s potential and the prevailing (and predicted) market environment, companies can make an informed decision on where to invest more capital, develop new products/services, or divest certain assets.

The BCG matrix enables a company’s management team to derive insights and develop a plan to improve their current product offerings, focusing on new information about new opportunities to pursue in their current (or adjacent) markets. The BCG growth-share matrix is a framework for companies to reference when refining and prioritizing their different businesses (and strategies). The growth share matrix created by the Boston Consulting Group (BCG) is a tool for identifying new growth opportunities and making informed capital allocation decisions to achieve long-term, sustainable growth.

The BCG Growth Share Matrix is a framework designed for companies to better understand a market’s current and future competitive landscape, which helps determine their long-term strategic plans.īCG Growth Share Matrix: Strategic Management Model

0 kommentar(er)

0 kommentar(er)